Receipt capture is the next mobile check deposit

Several top 20 banks have already launched receipt capture technology and dozens more will be implementing in 2017.

Within 1-2 years this will become an industry standard.

Several top 20 banks have already launched receipt capture technology and dozens more will be implementing in 2017.

Within 1-2 years this will become an industry standard.

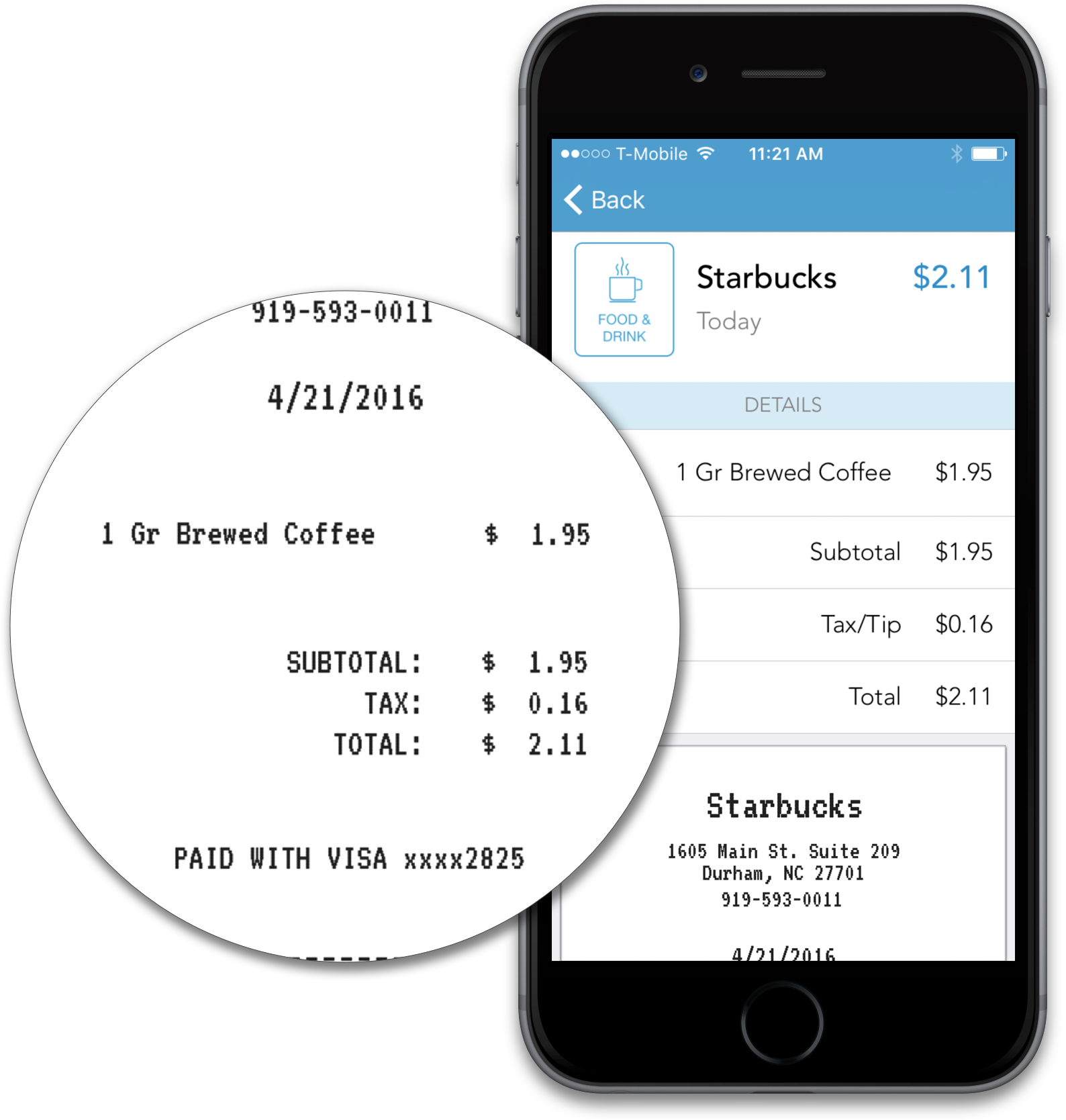

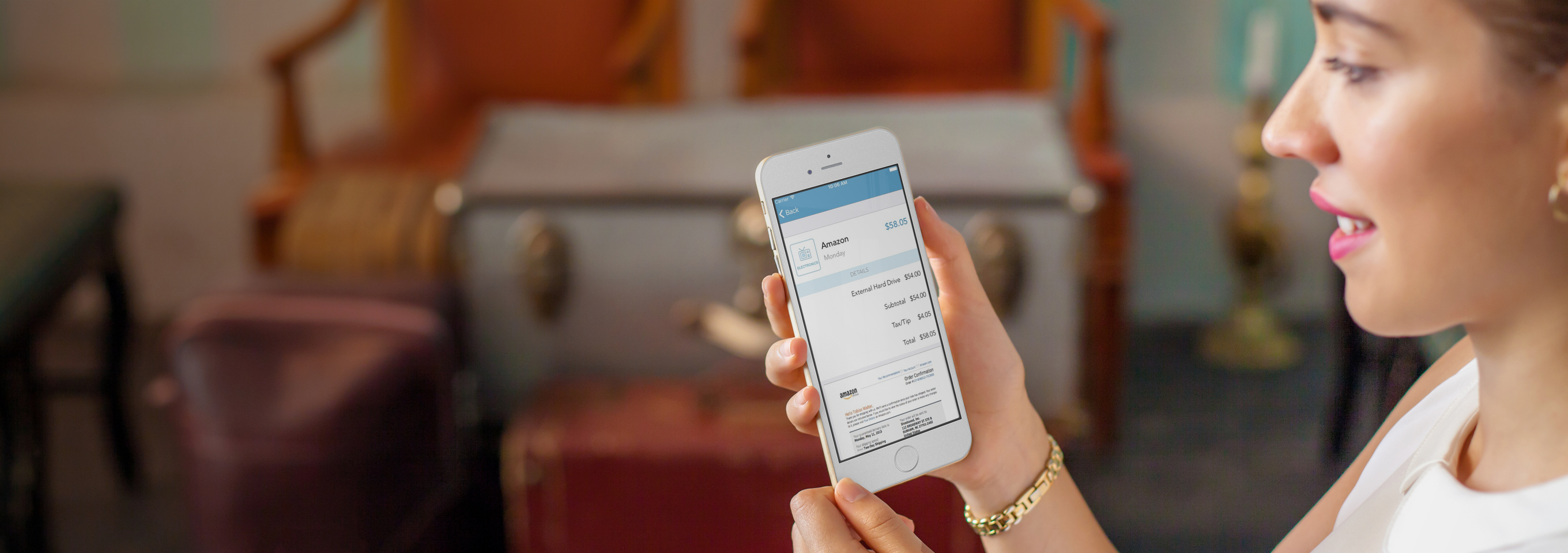

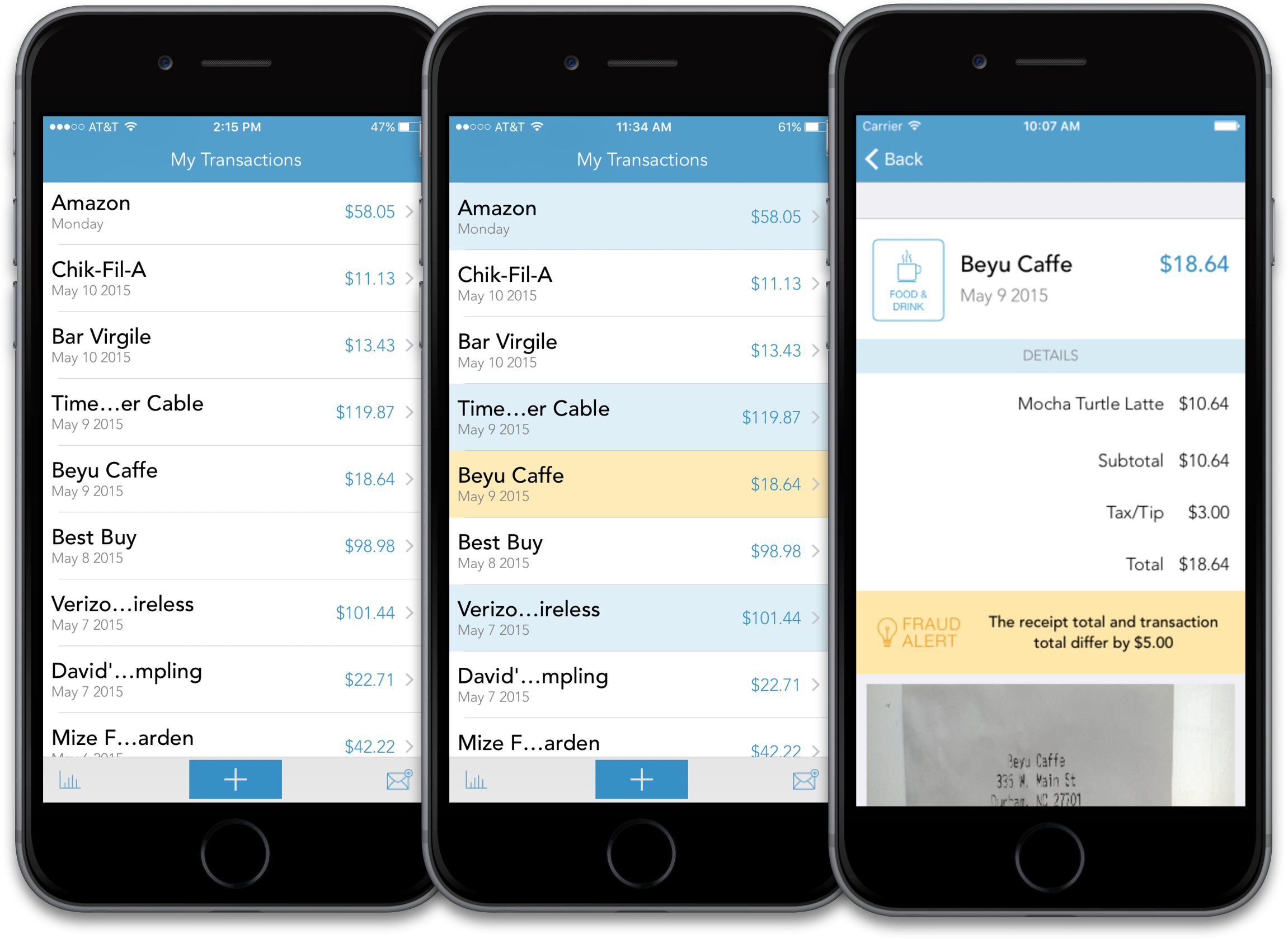

Our technology extracts SKU-level item data from both digital and paper receipts, opening up a world of payment interaction data and wallet share insight.

Shoeboxed offers a revolutionary service which gives customers a seamless way to match their digital and paper receipts to the transactions in their banking applications.

Empower customers by keeping them informed about their purchases and provide custom-tailored mobile banking features using SKU-level receipt data.

In addition to matching receipts to transactions, Shoeboxed extracts line-item data from receipts which gives users price drop notifications, recall alerts, return window reminders, warranty details and tip fraud protection.

“Receipt capture can serve as a differentiator for banks, and a convenient service benefit for consumers."

“Shoeboxed, for its Receipt Capture for Banks solution, which boosts the functionality of online and mobile banking apps while providing fraud protection.”

"Instead of seeing an accounting expense for Amazon.com, Shoeboxed would process that receipt so that the details of each item you purchased are properly categorized."

Shoeboxed is the pioneer of mobile and email receipt processing. Founded in 2007, Shoeboxed manages receipt capture solutions for multiple Top 10 banks and serves over one million users in 100+ countries. Shoeboxed’s Receipt Capture for Banks solution received Finnovate’s “Best in Show” award in 2015 and the company is listed as a Top Company Run by Entrepreneurs Under 35 by the United Nations’ Empact Showcase.